Piedmont Advantage Credit Union promotes Candice Champe to the Vice President of Innovation. In this newly-created position, Candice becomes an integral part of PACU’s senior leadership team to further PACU’s strategic efforts to advance its unique blend of personalized service with self-service digital offerings.

Stay in the know with Advantage Insight

Practical Ways to Save Money Amid Rising Costs

In today's economic climate, many of us are feeling the pinch at the grocery store and gas pump. With inflation affecting various aspects of life, finding ways to save money has become more crucial than ever. Here are eight practical steps that you can use to help accumulate savings.

Flying Colors Charity Fun Run

The PACU Foundation’s Second Annual Flying Colors Charity Fun Run achieved noteworthy success recently, raising $11,167. Megan Brooks, the event organizer, said, "The spirit of generosity and fun was unmistakable throughout the day. We are incredibly grateful for the commitment shown by everyone involved and look forward to continuing this momentum into next year.” Photo by: Aven Angel Photography

A Guide to "Pay Yourself First"

President & CEO Dion Williams introduced more than 40 middle schoolers at the Jim Shaw ACE Academy to one of his favorite topics, “Pay Yourself First.” Highlights from his remarks are as follows.

Managing your money may sound boring, but trust me, it's a skill that will pay off in the future. One of the best strategies to get you started on the right path is the concept of “Pay Yourself First.”

Understanding Net Worth: A Fun Guide

Parents and Teens! We have cool concept that’s super important for your financial future: Net Worth. Don’t worry, we’ll keep it fun and easy to understand. Let’s get started!

Imagine you have a giant piggy bank. Everything you own, from your bike to the money in your savings account, goes into that piggy bank. Net worth is a fancy way of saying how much you own after you pay off money you owe. It’s the ultimate scorecard for your finances!

The Realities of Debt Consolidation, Management and Settlement

The last few years have been financially challenging for many, including our neighbors and ourselves. We’ve navigated the fallout of a pandemic with soaring inflation, rising interest rates and now the resumption of student loan payments, all of which have put a strain on our household finances.

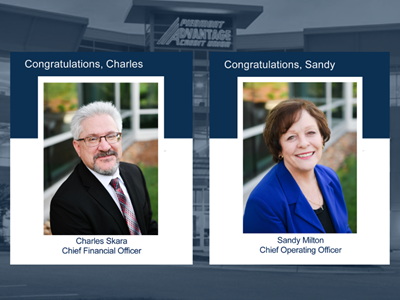

Congratulations, Charles and Sandy!

PACU is pleased to announce the recent appointments of two key executives to its leadership team. They are new hire Charles Skara as Chief Financial Officer (CFO) and newly promoted Sandy Milton as Chief Operating Officer (COO).

Is Cashless Cash Stuffing Possible? Learn how!

Admit it. Budgeting to save more money is difficult and frustrating, but it doesn’t have to be. If you’ve researched ways to save money, then you’ve heard about an old-school approach to saving that is gaining a new life among budget-conscious consumers. The approach is called Cash Stuffing.

Master Your Children's Banking Like a Pro

Ever get confused about the types of accounts you should be opening for your children and not know where to start? If so, no worries, we've got you covered! We will provide a comprehensive walkthrough on selecting the right bank accounts for your children, tailored by age and savings goals, to cultivate their money management skills from the start. This essential read is your roadmap to fostering financial literacy in your family.

Youth Savings Challenges For Your Kids and Teens

Ask your children, Are you ready to choose your first savings adventure? Intrigued, of course, their responses will be yes! Use our age-appropriate, savings challenge activities that will help your children set and reach realistic savings goals. Now, are you up to this unique family-fun savings adventure?