We're honored to announce that Yesenia Maldonado has joined PACU as a Member Relationship Team (MRT) Representative.

Stay in the know with Advantage Insight

Welcome, Amy Sand, to PACU

Amy Sands has joined PACU as Senior Accountant, supporting the financial management and operations of the Credit Union.

Conway and Semones earn certification

Debi Conway (right) and Jobana Semones become Certified Credit Union Financial Counselors through CUNA's Financial Counseling Certification Program.

Congratulations, Radha Karmamched

Piedmont Advantage’s BSA Compliance Analyst Radha Karmamched earned her Bank Secrecy Act Compliance Specialist (BSACS) Certification.

Marketing Intern Emily Winberg

PACU has taken on its first-ever marketing intern. Welcome Emily Winberg, a rising senior at the University of North Carolina Wilmington.

Megan Brooks, an emerging leader

PACU's Learning Facilitator Megan Brooks recently spoke on the Emerging Leaders Panel for Credit Unions Together Conference.

Yin and Yang

Call Center veterans Al Oliveri and Stacey Sandchez are featured in the March issue of Forsyth Family Magazine.

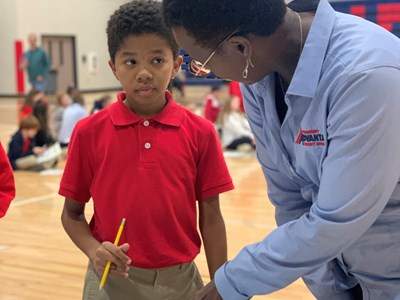

Reality of Money

We recently introduced approximately 150 middle school students at The North Carolina Leadership Academy to the Reality of Money, a crash course in personal finance. Judging from the students’ reactions, this event was an eye-opener.

The News on Fraud

Check out our latest blog concerning fraud and what scammers are doing to try and swindle you out of your hard-earned money. At Piedmont Advantage Credit Union we monitor and help fight against fraudsters. We hope this information helps you defend yourself from falling victim to fraud.

Home Equity vs HELOC

Using the equity in your home to pay off unsecured debt and/or make home improvements can be a hard financial decision. Low annual percentage rates, tax-deductible interest, and streamlining your monthly payment makes second mortgages extremely attractive. Meanwhile, using your home for collateral is a decision that should be weighed carefully.